technical vs fundamental analysis: which approach wins for day trading?

ask most traders whether you should use technical or fundamental analysis and you'll get the same lazy answer: "use both."

it's also useless advice if you're a day trader.

here's the reality: technical analysis and fundamental analysis are built for different timeframes. one dominates intraday trading. the other is nearly irrelevant for any trader holding positions for minutes or hours.

the debate between technical vs fundamental analysis isn't about which is "better" — it's about which one actually helps you make money based on how you trade.

let’s break it down:

table of contents

- what is fundamental analysis?

- what is technical analysis?

- key differences between technical and fundamental analysis

- why technical analysis wins for day trading

- when fundamental analysis actually matters

- how to combine both approaches

- frequently asked questions

- key takeaways

what is fundamental analysis?

fundamental analysis is the study of economic data, financial statements, and macro factors to determine an asset's "true value."

for stocks, fundamental analysts look at:

- earnings reports and revenue growth

- price-to-earnings ratios

- balance sheets and cash flow

- industry trends and competitive positioning

- management quality

for futures and indices, fundamental analysis focuses on:

- economic indicators (GDP, unemployment, inflation)

- central bank policy (Fed decisions, interest rates)

- geopolitical events

- supply and demand factors (for commodities)

the fundamental approach asks: "what is this asset actually worth?"

if the current price is below that value, you buy. if it's above, you sell or stay out.

the timeframe problem

here's one of the key differentiators with technical vs fundamental analysis.

fundamental analysis is inherently long-term.

earnings don't change intraday. GDP reports come out quarterly. Fed decisions only happen eight times a year. the factors that fundamental analysts study move slowly — over weeks, months, or years.

by the time fundamental data is released, the market prices it in almost instantly. you're not analyzing the data — you're reacting to everyone else's analysis of the data, which can be incredibly difficult to do if you don’t have the right tools.

what is technical analysis?

technical analysis is the study of price action, volume, and chart patterns to build an idea of where future price movements could be.

technical analysts look at:

- support and resistance levels

- chart patterns (head and shoulders, triangles, flags)

- indicators (moving averages, RSI, MACD)

- volume and order flow

- time-based setups (opening range, initial balance, gap fills)

the technical approach asks: "where is price likely to go next?"

it doesn't care why price is moving — only that it IS moving and that patterns tend to repeat.

the core assumption for technical vs fundamental analysis

technical analysis is built on one principle: price discounts everything.

all the fundamental data, all the news, all the sentiment — it's already reflected in the current price. by studying price itself, you're studying the sum total of everyone's analysis.

this makes technical analysis fractal — you can apply it to a 1-minute chart or a monthly chart. the same principles work whether you're holding for 5 minutes or 5 years.

for day traders, that flexibility is everything.

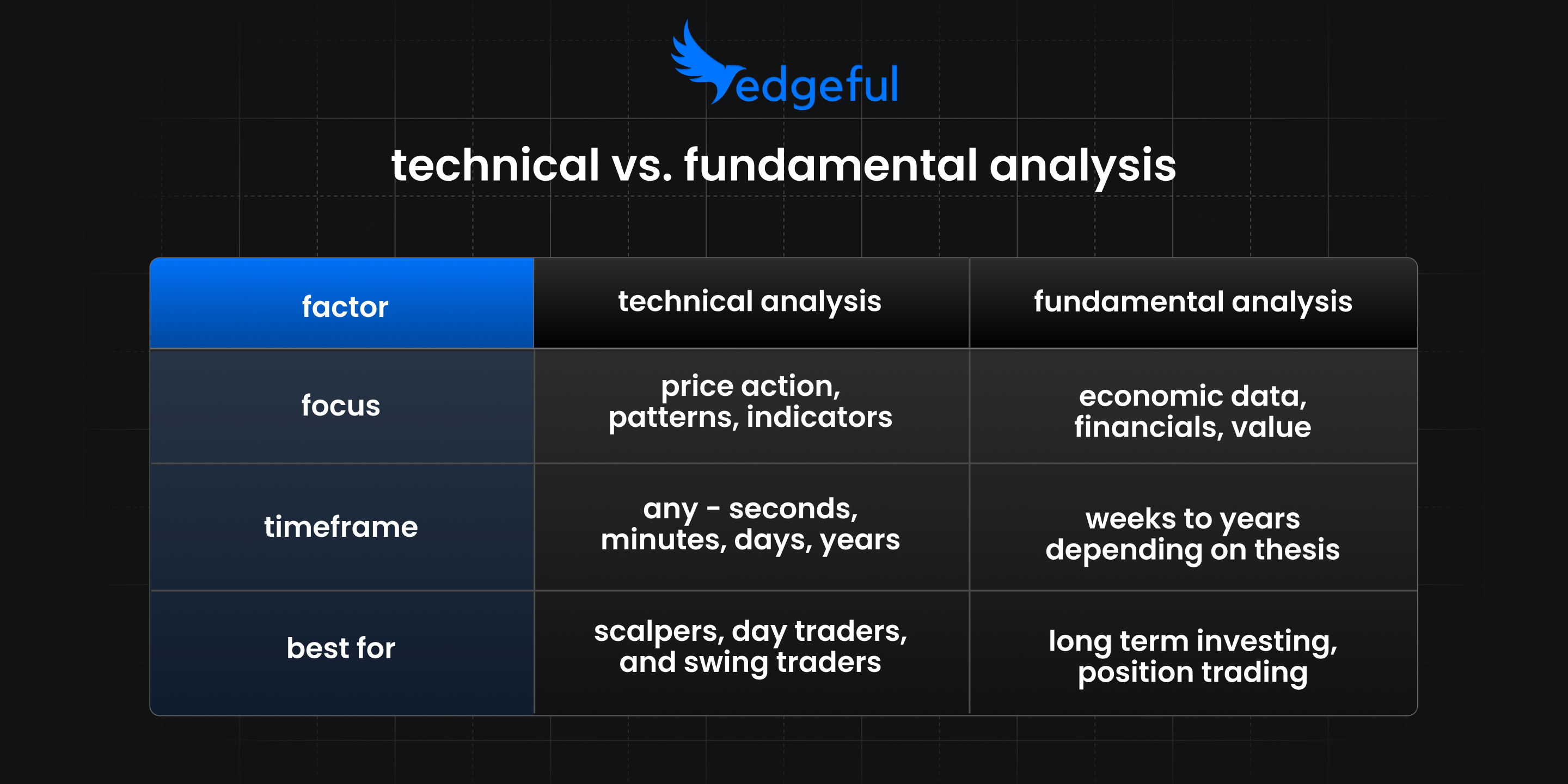

key differences between technical vs fundamental analysis

here are some key differences between technical vs fundamental analysis:

why technical analysis wins for day trading

let's be direct:

when you look at technical vs fundamental analysis for day trading, technical analysis isn't just better — it's the only approach that makes sense.

here's why.

1. price reflects fundamentals instantly

when news drops, the market doesn't wait for you to analyze it.

FOMC announcements move ES futures within seconds. by the time you've read the statement, the move has happened. you're not trading the fundamentals — you're trading the technical reaction to the fundamentals.

the edge isn't in knowing what the Fed said. it's in knowing how price typically behaves after it says it. and lucky for you — we have a report that helps you analyze and trade FOMC reactions.

2. fundamentals don't change intraday

the S&P 500's earnings didn't change between 9:30 AM and 4:00 PM. GDP is the same at market close as it was at market open. inflation data doesn't update mid-session.

if the fundamental picture is identical throughout your trading day, how can it help you decide when to enter and exit?

it can't.

3. technical setups have measurable edge

here's what separates technical analysis from fundamental guesswork: you can backtest it.

edgeful tracks thousands of technical setups across multiple instruments and sessions. the data shows:

- initial balance single breaks have predictable follow-through patterns

- gap fills occur with measurable probability based on gap size and direction

- opening range breakouts show consistent behavior in the first 15-30 minutes

you can't backtest "the economy looks strong." you CAN backtest "when IB breaks to the upside on ES, what happens next?"

for a deep dive into IB setups, check out our initial balance breakout strategy guide.

4. precise risk management

technical analysis gives you exact levels.

- enter at this price

- stop loss at that price

- target at this level

here’s an example of our automated ORB algo strategy, with clear entry, exit, and take profit levels visualized on a chart:

when fundamental analysis actually matters

technical analysis wins for day trading. but that doesn't mean fundamentals are useless.

here's when they matter — even for short-term traders.

high-impact news events

FOMC days. CPI releases. NFP reports.

on these days, the fundamental data creates the volatility you're trading. you need to know WHEN these events happen and WHAT the market expects.

technical analysis tells you how to trade the reaction. fundamental awareness tells you when to expect the reaction.

our FOMC trading guide linked above breaks down how to approach these high-impact sessions.

longer-term bias

if you're trading NQ and the Fed just signaled more rate cuts, that's useful context. it doesn't tell you where to enter today, but it might inform your directional bias.

think of fundamentals as the weather forecast. technicals are what you actually see when you step outside.

explaining moves after the fact

price drops 2% and you want to know why? fundamentals explain it. but by the time you have that explanation, the move is over.

this is useful for learning and context. it's not useful for making money intraday.

position sizing decisions

if you're trading during a high-risk fundamental event (like an election or major policy decision), you might reduce size. this is one way you can use fundamental awareness to guide your risk management..

how to combine both approaches

the technical vs fundamental analysis question isn't either/or — it's knowing which to use when. here are your steps:

- step 1: check the calendar

before the session, know what's scheduled. FOMC? CPI? earnings for a stock you trade? these fundamental reports usually have an impact on price, so it’s important to adjust your trading on news events days.

- step 2: adjust expectations

high-impact news days are different. volatility expands. ranges are wider. setups may be less reliable until after the release. factor this into your trading plan if you haven’t backtested the impact of these reports before.

- step 3: trade the technicals

once you're in the session, fundamentals are in the rearview mirror. focus on:

- where are the key levels? (previous day high/low, IB range, gap fill targets)

- what does the data say about these setups?

- where is your entry, stop, and target?

these are the questions you must know how to answer if you're going to trade using technical analysis.

- step 4: let price confirm

even if you have a fundamental bias ("Fed was dovish, I'm looking long"), wait for technical confirmation.

for more on building a pre-market routine, check out our day trading strategies for beginners guide.

frequently asked questions

which one is better in the technical vs fundamental analysis debate?

neither is universally "better." technical analysis is better for short-term trading (day trading, scalping, swing trading). fundamental analysis is better for long-term investing. the right approach depends entirely on your timeframe.

can you be profitable using only technical analysis?

yes. most successful day traders use technical analysis exclusively for their entry and exit decisions. the setups, levels, and patterns are enough to build a profitable edge without analyzing economic data.

do professional traders use fundamental or technical analysis?

both — but they use them for different purposes. hedge funds might use fundamentals to decide WHAT to trade and technicals to decide WHEN. day traders at prop firms typically focus almost entirely on technicals because their holding periods are too short for fundamentals to matter.

why do people say you should use both?

because it sounds balanced and safe. and for longer-term trading, it's true — fundamentals help you pick good assets, technicals help you time entries. but for day trading, the "use both" advice misses the point. fundamentals simply don't change fast enough to inform intraday decisions.

what's the best technical analysis strategy for beginners?

start with time-based setups that have clear rules: opening range breakouts, initial balance breakouts, and gap fills. these have defined entry points, measurable probabilities, and straightforward risk management.

key takeaways

- fundamental analysis studies economic data and financials to determine value — best for long-term investing

- technical analysis studies price action and patterns to predict moves — works on any timeframe

- for day trading, technical analysis wins because fundamentals don't change intraday

- price reflects fundamental news almost instantly — you're trading the reaction, not the data

- technical setups can be backtested and measured; fundamental "value" cannot

- use fundamentals for calendar awareness (knowing when high-impact events occur)

- use technicals for actual trading decisions (entries, exits, stops, targets)

- the "use both" advice is only useful if you understand which one applies to your timeframe